We invest in building

the leaders of tomorrow:

The Innovators!

About Us

FinHealth Gestão de Recursos Ltda

is an investment manager specialized in Life Sciences and Healthcare and focused on companies at an early stage or still in the growth phase.

Structured as a partnership of investment professionals, FinHealth manages life sciences and healthcare funds aimed at institutional and professional investors.

Also, on a fiduciary basis it also manages several financial services and real estate for its partners and investors.

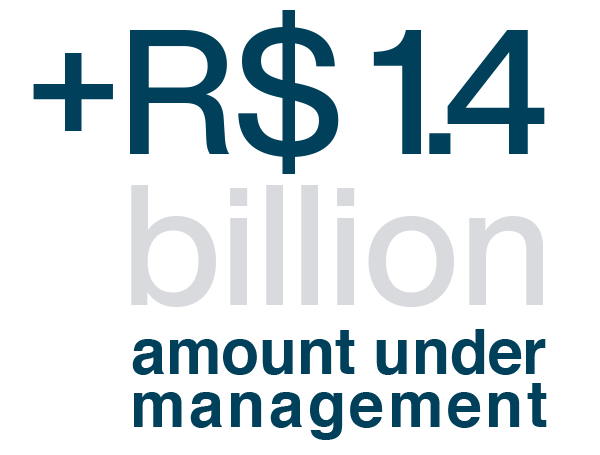

The funds managed by FinHealth add up to over R$1.4 billion as follows:

The funds managed by FinHealth total more than R$1.4 billion in amount under management as follows:

Private Equity e Venture Capital:

FinHealth I

FIPEEI

Finvest Real

Estate II FIP

Finvest Capital Partners FIP

Securitas Biotech

Our mission

FinHealth's mission is to invest in commercial or pre-commercial stage companies, led by differentiated entrepreneurs who have highly competitive products, technologies, or services, in order to achieve consistent returns for our investors.

Since we are specialists in the 2 sectors in which we operate, we believe that our degree of success is much higher than that of generalist managers.

We are very participative investors in our investees, forming long-term partnerships with entrepreneurs, investors, and industry professionals in order to generate trust, credibility, and value in all our relationships.

Whenever necessary, we provide outsourced back-office services through our Shared Services Center and designate our experts to work out the investees. This allows entrepreneurs to dedicate themselves to what is really essential for their company in its inception.

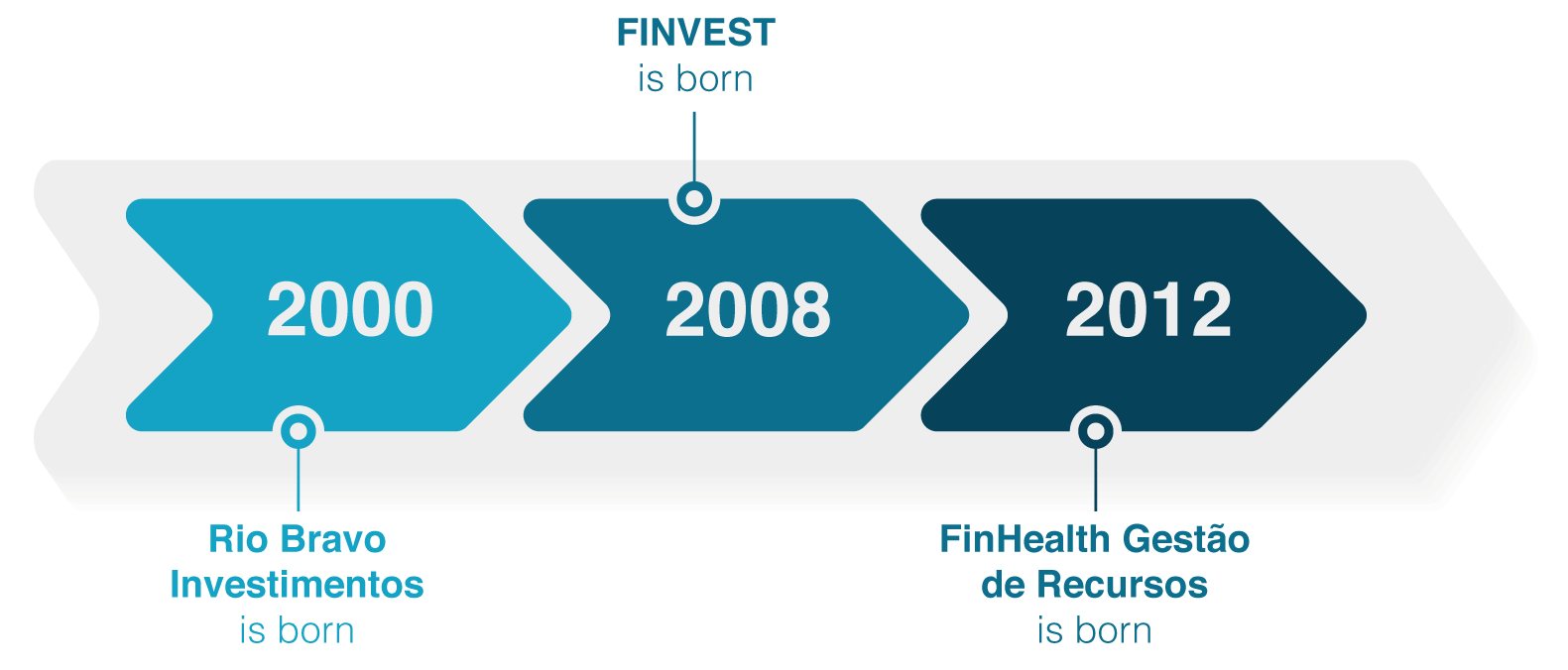

Our history

In the beginning of 2000, upon leaving Banco Pactual, Luis Claudio Garcia de Souza, formed a joint venture with Securitas Capital, Swiss Re's Private Equity arm for financial services and insurance, to operate in Latin America. Thus, with the participation of Paulo Bilyk and Gustavo Franco, Rio Bravo Investimentos was founded, which, over time, expanded and began to offer a wider range of financial services, including “corporate and project finance” as well as “wealth management”.

In 2008, to recover the original focus on private equity and venture capital in financial services, particularly in credit and real estate, Luis Claudio withdrew from Rio Bravo with his team and formed a new manager, Financial Investimentos (“FINVEST”).

In 2012, Luis Claudio acquired a relevant share of Burrill Brasil Investimentos, an investment manager specializing in healthcare and life sciences, created by João Paulo Poiares Baptista, a former partner of his at Rio Bravo, which later absorbed FINVEST’s operations and was renamed FINHEALTH.

Investment strategy

:In the Healthcare and Life Sciences area, our investment strategy is focused on the most relevant trends in the sector today, such as:

Health services (hospitals, specialized clinics, and/or corporate service companies, among others)

Diagnostic Services

Biopharmaceuticals for human and animal health (including new drugs development)

Digital Health e CROs

Medical equipment

In the area of Financial Services, we initially sought to create companies that would make use of innovative financial instruments aimed at capital markets that would compete with the extremely inefficient banking products offered by large financial conglomerates.

In a second phase, we made a bet on the disruptive power of the digitalization of financial services and on data science as a truly innovative competitive advantage. In most cases, the portfolio companies had a relevant focus on real estate.

Documents CVM Instruction 558/2015

Portfolio

Team

Our team is trained internationally and locally so that your needs and the environment in which you do business are well understood.

João Paulo Vasco Poiares Baptista

Senior managing partner, responsible for the Healthcare and Life Sciences strategy, as well as for trusteeship (ICVM 558/2015).

Luis Claudio Garcia de Souza

Senior managing partner, responsible for asset management (ICVM 558/2015), for the Financial Services strategy, and co-responsible for the Healthcare and Life Sciences strategy.

contact us

Contact

Rio de Janeiro branch

Rua Visconde de Pirajá, 623

9th floor – Ipanema

22.410-003

Rio de Janeiro - RJ - Brazil

contato@finhealth.com.br

All Rights Reserved | FinHealth

São Paulo branch

Av. Santo Amaro, 48,

3rd Floor - Itaim Bibi,

04506-000

Sao Paulo - SP - Brazil

contato@finvest.com.br

Copyright @ 2022 Finhealth | Privacy Policy